Navi Loan App Review Real or Fake: Friends, are you looking for such a loan application which provides you loan at low interest. So friends, Navi Loan App is the best app available on Google Play Store, but many people have a doubt whether it is safe to take loan from Navi Loan App or not? And is this Navi Loan App real or fake?

Friends Reviewjano.in is a place where you can get real reviews. In this blog post, I am going to do an in-depth review of Navi Loan App along with its interest rate, repayment time and most importantly, is this app good or not.

Table of Contents

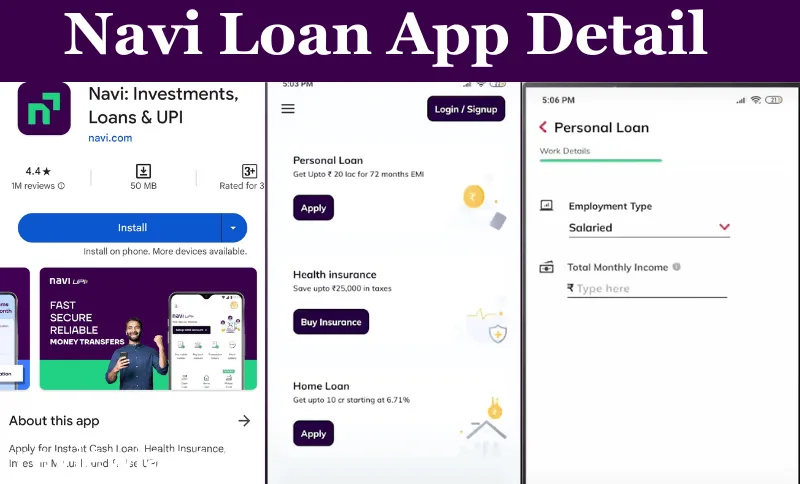

Navi Loan App Details

| App Name | Navi Loan |

| App Category | Finance |

| App Features | Loan, Insurance, UPI, Mutual funds, etc. |

| App Downloads | 5 Cr+ Downloads |

| Loan Amount | Upto 20 Lakhs |

| Navi Loan Interest Rate | 9.9% P.A. to 45% P.A. |

| Navi Loan Repayment Time | 72 Months |

| RBI Approved | Yes |

| Rating | 4.4 out of 5.0 |

| Real or Fake | Real |

The Navi loan application was launched in 2020 by Sachin Bansal, ex-CEO of Flipkart. It is one of the first instant loan approval apps that allow users to get a fast loan of up to Rs 5 lakh. It has a simple and easy-to-navigate dashboard and an affordable interest rate based on the user’s profile. Users have a convenient way to control their credit without handling much paperwork.

Navi Loan App is available on Google Play Store with a rating of 4.4 out of 5. Navi App offers a paperless loan process with lower interest rates and no extra charges.

Read more:-

How to Avail Loan from Navi App?

- Install Navi app from Play Store or App Store.

- Open the application and register using your mobile number.

- It will ask you to complete the account by entering basic details.

- Selecting the loan amount and EMI amount.

- Now, app will open a new tab and ask you to complete the KYC process.

- After you finish filling in the KYC details, you’ll need to link your bank account to receive the loan amount.

- Once you put in your bank information, your money will be transferred within a few minutes.

Navi Loan App Requirements

The Navi Loan App isn’t for everyone. If you handle your money on your own and are interested in trying out financial services or products, the Navi App could be just right for you. To apply for a loan, you need to meet the following requirements:

- Resident: Applicant should be a resident of India with a government-issued ID card.

- Age: To get loan, you need to be at least 21 years old, and for a home loan, you should be at least 22 years old.

- Applicant must be salaried or Self- Employed.

Documents Required to Get Loan from Navi App

Typically, you have to upload your PAN and Aadhaar card information. The app will also request other basic details to make sure you can get a loan at a reasonable rate. However, when applying for a loan on the Navi app, be aware that there’s a processing fee. It’s 2.5%, with a minimum of Rs 500 and a maximum of Rs 5000, not including 18% GST.

Pros and Cons Of Navi Loan App

Pros:-

- Navi Loan app is available in play store with a rating of 4.4 out of 5.

- Navi Loan app dashboard is very user friendly.

- The Navi App provides quick approval for loans and immediate access to credit.

- Navi Loan app provides higher loan ammount up to 20 lakh.

- Navi Loan app offers various financial products and services like mutual funds, health insurance, home loans, and more.

- Navi Loan app has do not charge any extra processing fee.

- You can easily check whether you are eligible to get a loan or not.

- The loan request is processed completely digitally and transferred money just after approval.

Cons:-

- According to me there is no any problem with Navi Loan App. But some user have complain with their customer support.

- The loan’s interest rate can vary from 9% to 36% per annum.

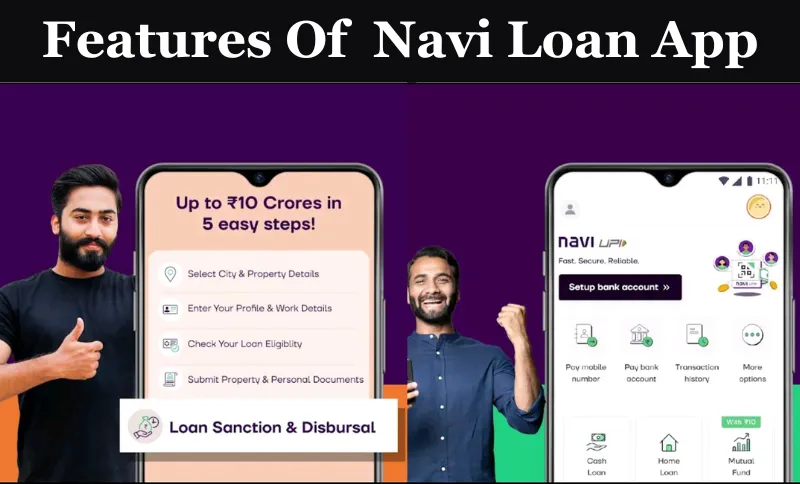

Features Of Navi Loan App

- Navi loan app gives loans for three months to seven years.

- Navi app loan request process is very fast.

- In Navi loan app applicants must request a loan of at least Rs 10,000.

- In Navi app you can also select the EMI ammount based on your salary or income sources.

- The Navi Loan App is a mobile app designed to assist individuals in handling their finances and monitoring their loans.

Navi Loan App Review: Real or Fake

The Navi Loan App is a secure and trustworthy mobile application found on the Google Play Store, earning a rating of 4.4 out of 5. If you’re looking to borrow money, invest, and more, Navi App is a reliable choice. Navi is a genuine platform created to help users with their financial challenges by offering the right financial services and products.

The Navi loan app is not a scam or fake it is 100% safe or real. The Navi loan app is 100% digital and paperless. It gives instant transfer of money into the customer’s account.

But whenever you take a loan, keep these things in your mind:-

- Reading all the “Terms and conditions” very carefully.

- Check your CIBIL score before applying.

- Take loan as per your capacity.

- Calculate your EMI for loans

Navi Loan App Customer Service Details

| Customer Care Number | +91 81475 44555 |

| Customer Support Email | help@navi.com, grievance@navi.com |

| Office Address | Navi Technologies Private Limited, 3rd Floor, Salarpuria Business Centre, 93, 5th A Block, Koramangala, Bangalore – 560095 |

FAQ:

Is Navi loan app RBI approved?

Yes, the Navi loan app is RBI approved.

Navi loan app documents required.

Government issue ID card like PAN card or Aadhar card.

What CIBIL score is required for Navi loan?

A minimum credit score between 650- 750 is good for being eligible for a home loan.

Conclusion

Navi Loan App stands out as a secure and user-friendly platform available on the Google Play Store. With a solid rating of 4.4 out of 5, it provides a reliable solution for managing finances, tracking loans, and addressing various financial needs. Navi’s commitment to offering safe and effective financial services makes it a trusted choice for users seeking convenient and trustworthy solutions.

Your posts in this blog really shine! Glad to gain some new insights, which I happen to also cover on my page. Feel free to visit my webpage Article Star about Blogging and any tip from you will be much apreciated.